nh meals tax rate

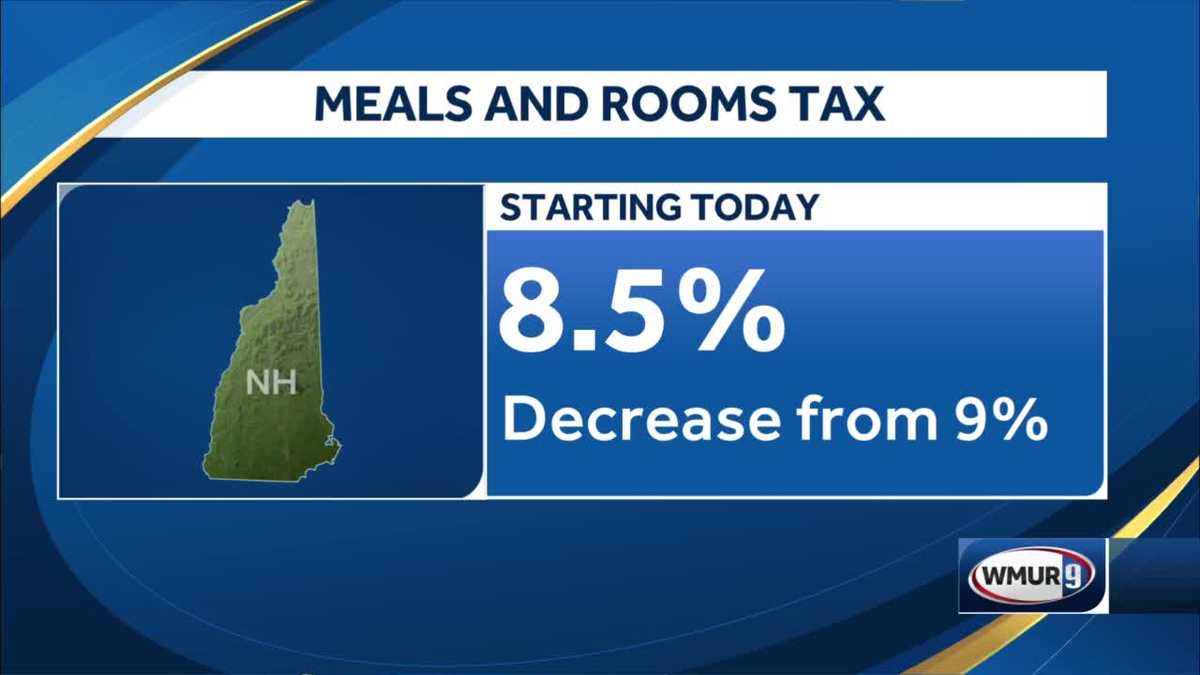

New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety.

Starting October 1 2021 the New Hampshire Department of Revenue Administration NHDRA is decreasing the states Meals and Rooms Rentals Tax rate from 9 to 85.

. To ensure a smooth transition to the new tax rate we are reminding. Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85. Chapter 144 Laws of 2009 increased the rate from 8 to the current rate.

Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85. New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. 2022 New Hampshire state sales tax.

The state meals and rooms tax is dropping from 9 to 85. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. New Hampshire is one of the few states with no statewide sales tax.

Years ending on or after December 31 2025 NH ID rate is 3. This budget helps consumers by reducing the Meals and Rooms Tax from 9 to 85 its lowest level in over a decade. Multiply this amount by 09 9 and enter the result on Line 2.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. You only have to file a New Hampshire Income Tax Return if you have earned over 2400 annually 4800 for joint filers. This budget helps small businesses by reducing the Business Enterprise Tax BET from 06 to 055.

Some rates might be different in Exeter. Income tax is not levied on wages. Exact tax amount may vary for different items.

But while one business tax is producing significant. Reducing our MR tax rate makes New Hampshire marginally more competitive with Maine and Vermont both of which have a 9 lodging tax. Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent.

The New Hampshire income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Tablafina serving meals throughout the day.

New Hampshires individual tax rates apply to interest and dividend income only. Chris Sununu in this years budget package which passed state government in June. We simply charge a state mandated NH Rooms Meals Tax at a rate of 9 which will be calculated and clearly noted during the booking process.

1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting. Concord NH The. Advertisement Its a change that was proposed by Gov.

The current tax on NH Rooms and Meals is currently 9. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. 1-800-735-2964 fax.

Meals and Rentals TaxRSA Chapter 78-A. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. Years ending on or after December 31 2026 NH ID rate is 2.

NH Meals and Rooms tax decreasing by 05 starting Friday. 1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting. New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals Tax ratewill decrease by 05 from 9 to 85.

The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more. New Hampshires sales tax rates for commonly exempted categories are listed below. Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the customer receipt or check.

Increasing the percentage returned to towns means that even with the reduced rate towns will see an increase in the MR tax distribution. Years ending on or after december 31 2027 nh id rate is 0. To be used as a restaurant this storefront needs to be plumbed and wired.

NH Meals and Rooms Tax. New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access Relay NH. There are however several specific taxes levied on particular services or products.

The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5. Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals Tax rate will decrease by 05 from 9 to 85. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

Meals and Rooms Tax Where The Money Comers From TransparentNH. Annual Meals Rooms Tax Distribution Report Revenue to Cities and Towns MR Tax Homepage MR Tax Frequently Asked Questions. New hampshire could lose more than a 250 million in revenue over the next four years if four bills introduced thursday in the new hampshire house ways.

If you look at the monthly revenue reports from Administrative Services you will see that to date this fiscal year business taxes have produced 7452 million which is 1244 million more than budget writers anticipated and is the major source of the current 252 million revenue surplus. Starting october 1 the tax rate for the meals and rooms rentals tax will decrease from 9 to 85. The rate is reduced to 875 beginning on or after October 1 2021.

Years ending on or after December 31 2027 NH ID rate is 0. The Meals and Rooms Tax is assessed to customers of hotels restaurants or other businesses providing taxable meals room rentals and motor vehicle rentals.

Anti Inflammatory Diet Meal Prep 6 Weekly Plans And 80 Recipes To Simplify Your Healing Amazon Co Uk Hultin Ginger 9781647393229 Books

New Hampshire Sales Tax Rate 2022

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

House Approves Bill To Put Education Fund Surplus Toward Universal Meals Vtdigger

New Hampshire Meals And Rooms Tax Rate Cut Begins

Street Food At Home Recipe Collection Land O Lakes Fair Food Recipes Food Truck Food

Udi S Gluten Free Three Cheese Ravioli 18 Oz Walmart Com

The Reserve Bank Of India Rbi Held Its Policy Rate At 7 25 Percent On Tuesday Pausing As Widely Expected After A Spike In Fo Supportive Japanese Yen Hold On

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation

Sununu S Pitch To Suspend Rooms And Meals Tax Worries Nh Town Officials

2021 Business Meal Deductions Caa Temporary Changes Bethesda Cpa

Amazon Com Omeals Lentils W Beef Mre Six Meals Sustainable Premium Outdoor Food Extended Shelf Life Fully Cooked W Heater No Refrigeration Perfect For Travelers Emergency Supplies Usa Made

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Amazon Com Omeals Lentils W Beef Mre Six Meals Sustainable Premium Outdoor Food Extended Shelf Life Fully Cooked W Heater No Refrigeration Perfect For Travelers Emergency Supplies Usa Made

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

Food Franchise Report 2018 Franchisedirect Com

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax Money Choices