carried interest tax rate 2021

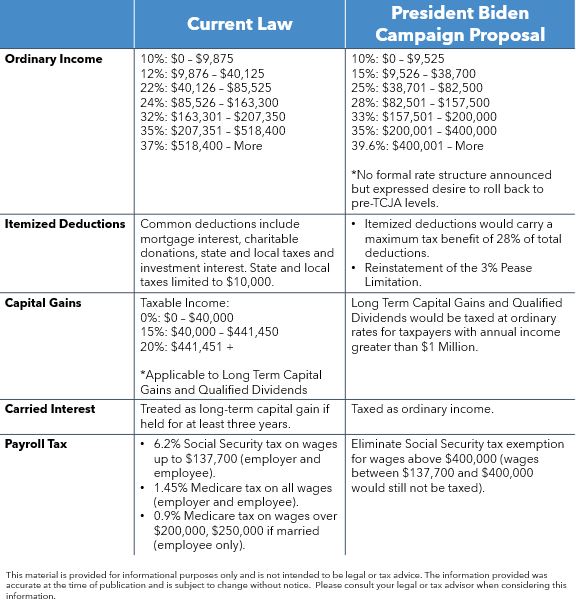

Managers with a holding period of less than five years would incur short-term capital gains tax rates on carried interest a 37 top rate the same that applies to wage and. The Carried Interest Exemption.

Study Raising Taxes On Carried Interest Capital Gains Will Eliminate 4 9 Million Jobs Americans For Tax Reform

Carried Interest Fairness Act of 2021 Senators Baldwin Manchin and Brown.

. The carried interest tax loophole is an income tax avoidance scheme that allows Wall Street executives to substantially lower the amount they pay in taxes. Trump then signed the 2017 tax bill and failed to keep his promise to eliminate the tax break for wealthy hedge fund managers. Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest continues.

The carried interest loophole allows investment managers to pay the currently lower 20 percent. In January 2021 the US. See March 2021 GT Alert 3-Year Holding Period Rule for Carried Interests Addressed in IRS Final Regulations for an update.

The Congressional Budget Office has estimated that taxing carried interest as ordinary income. Carried Interest Fairness Act of 2021 Senators Baldwin Manchin and Brown. Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of the Internal Revenue.

On July 31 2020 the Department of Treasury. 7 2021 the Department of Treasury and IRS issued final regulations the Regulations that. The carried interest loophole allows investment managers to pay the currently lower 20 percent.

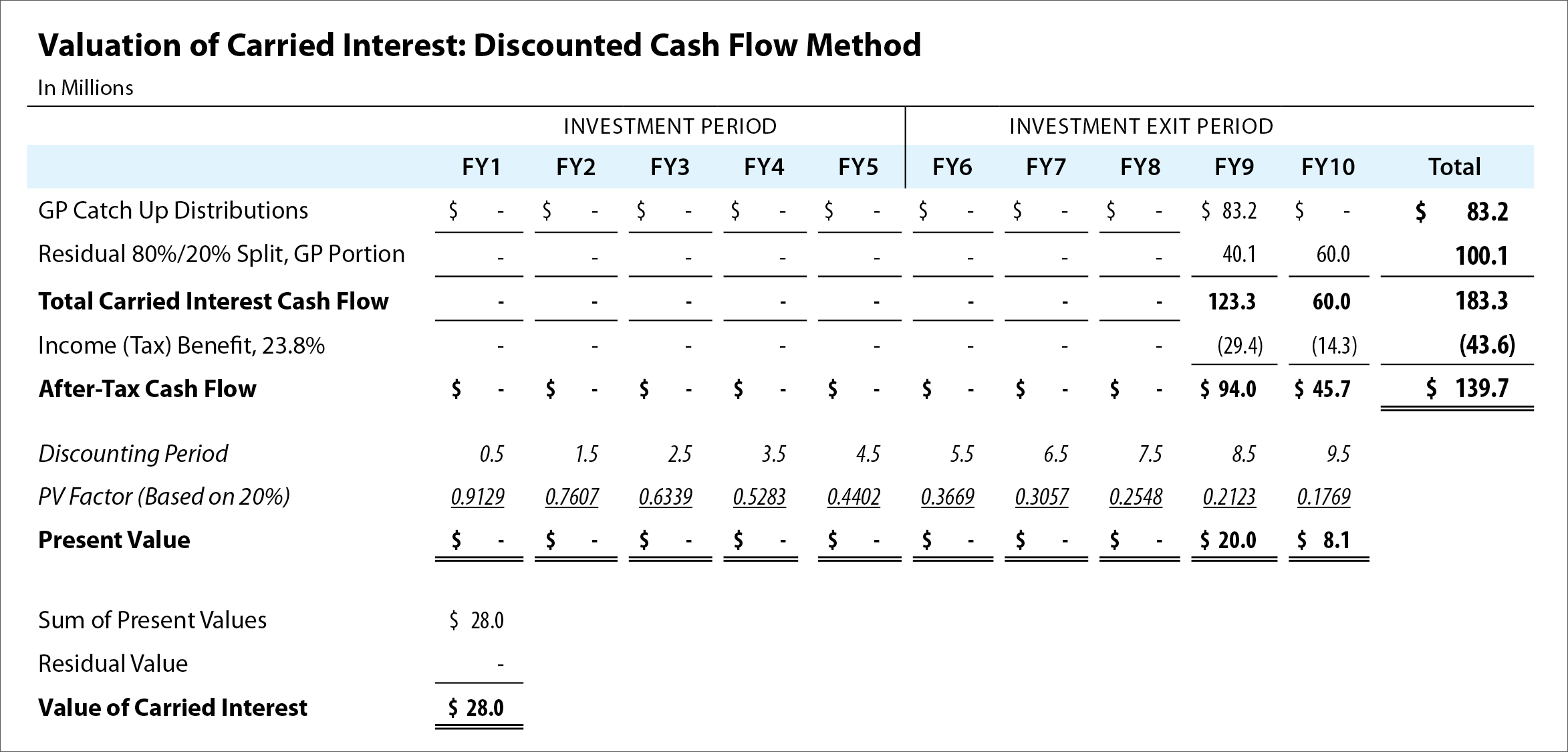

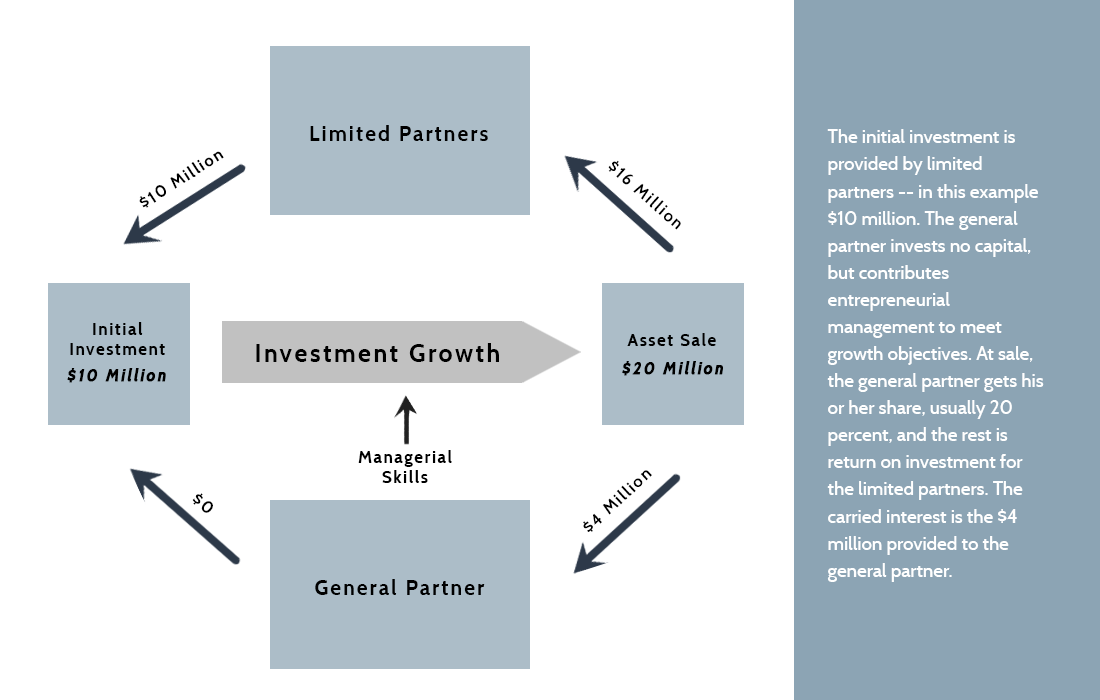

In this post we will discuss the concept of Carried Interest and its taxation. According to a news release from Pascrell Levin and Porter the Carried Interest Fairness Act of 2021 would tax certain carried interest income at ordinary income tax rates. Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not they.

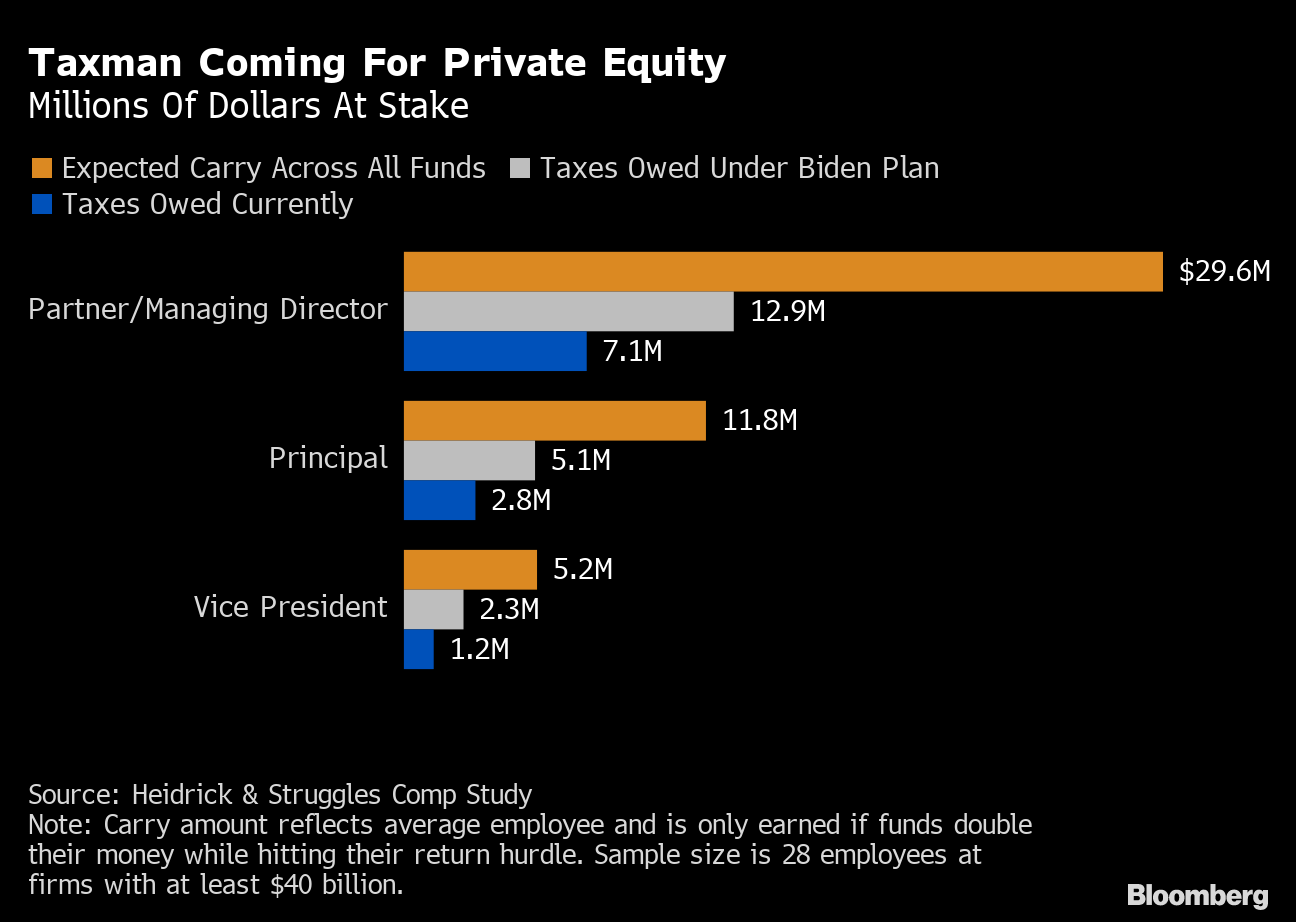

Where the DIMF rules apply amounts which are in substance management fees are subject to tax as trading income regardless of the underlying. President Joe Bidens plans would tax carried interest which private equity managers earn from the investments they make at rates as high as 396 against 20 today. House Democrats Float 265 Top Corporate Rate in Tax Blueprint.

Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG rates instead. President Bidens American Families Plan calls on. Every president since George W.

What Are Capital Gains Taxes And How Could They Be Reformed

Carried Interest Would Be Taxed At Ordinary Income Tax Rates Under Newly Proposed Legislation Choate Hall Stewart Llp

States Are Taking Aim At Pe S Carried Interest Loophole Pitchbook

The Great Compression Middle Market Growth

Carried Interest In Private Equity Calculations Top Examples Accounting

Lobbying Kept Carried Interest Out Of Biden S Tax Plan Bernstein Says

Biden S Carried Interest Tax Would Force All Partnerships To Carry Big Burden Competitive Enterprise Institute

Carried Interest Regulations And The Future Of A Debated Tax Break 2021 Articles Resources Cla Cliftonlarsonallen

Scanning The Horizon In A Sea Of Noise Rockefeller Capital Management

How To Tax Capital Without Hurting Investment The Economist

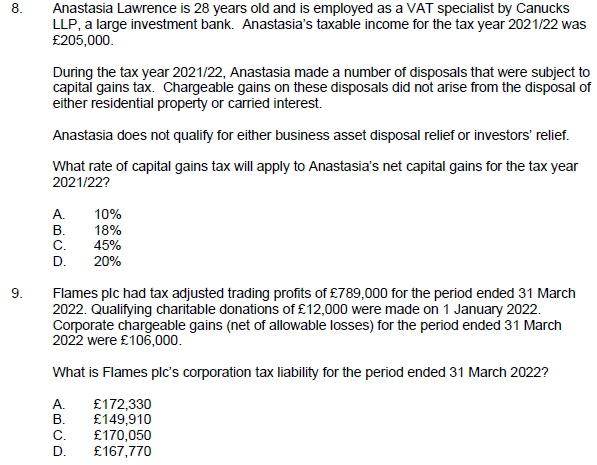

Solved 8 Anastasia Lawrence Is 28 Years Old And Is Employed Chegg Com

Carried Interest Tax Break For Private Equity Survives Another Attempt To Kill It Barron S

Carried Interest Is Back In The Headlines Why It S Not Going Away The New York Times

This Tax Loophole Costs 180bn A Decade Why Won T Democrats Close It Robert Reich The Guardian

From The Foundation President Aaml Foundation

The Tax Treatment Of Carried Interest Aaf

Carried Interest Tax Private Equity Billionaires Angry Over Closing Loophole Bloomberg

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center